We are committed to embedding sustainability into all aspects of our operations, creating long-term value for our investors and stakeholders.

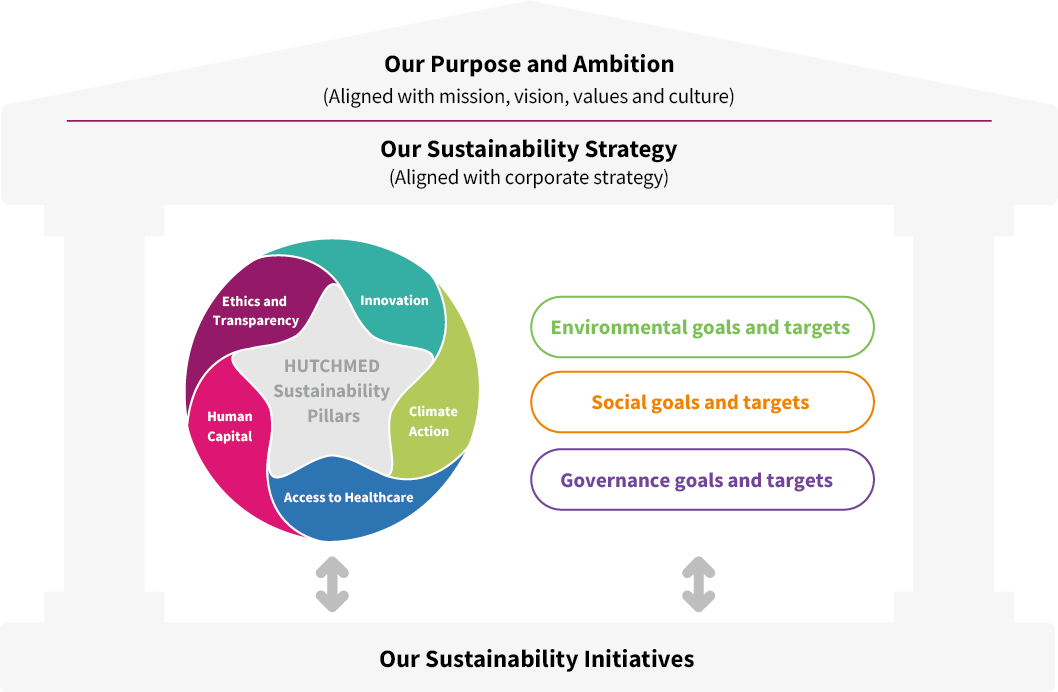

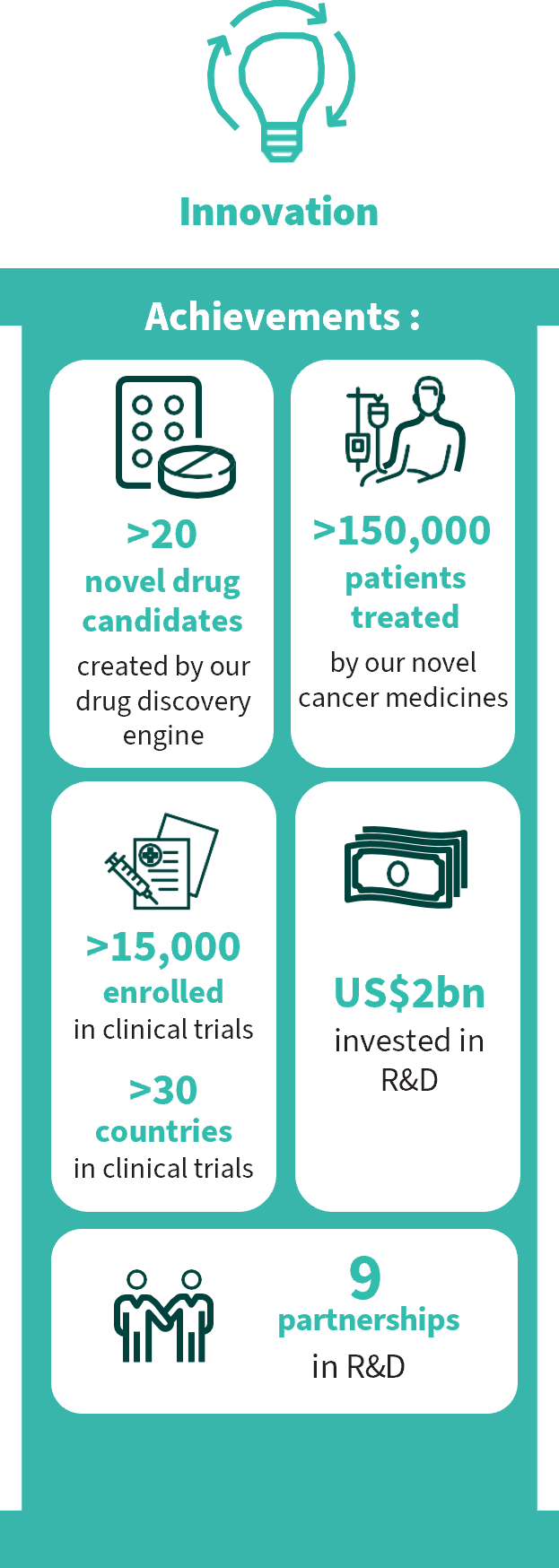

Building on the substantial initiatives of the previous years and with reference to the latest sustainability standards, we developed a holistic sustainability framework covering areas that are central to our industry – climate action, innovation, ethics and transparency, human capital, and access to healthcare. This framework serves as a comprehensive guide to ensure that sustainability remains a core element across every facet of our business.

Sustainability Strategy

Our sustainability strategy framework is integrated into every aspect of our business decisions, built on the five pillars below, and further extends to nine focus areas covering the 11 short to long-term sustainability goals and targets set in 2022.

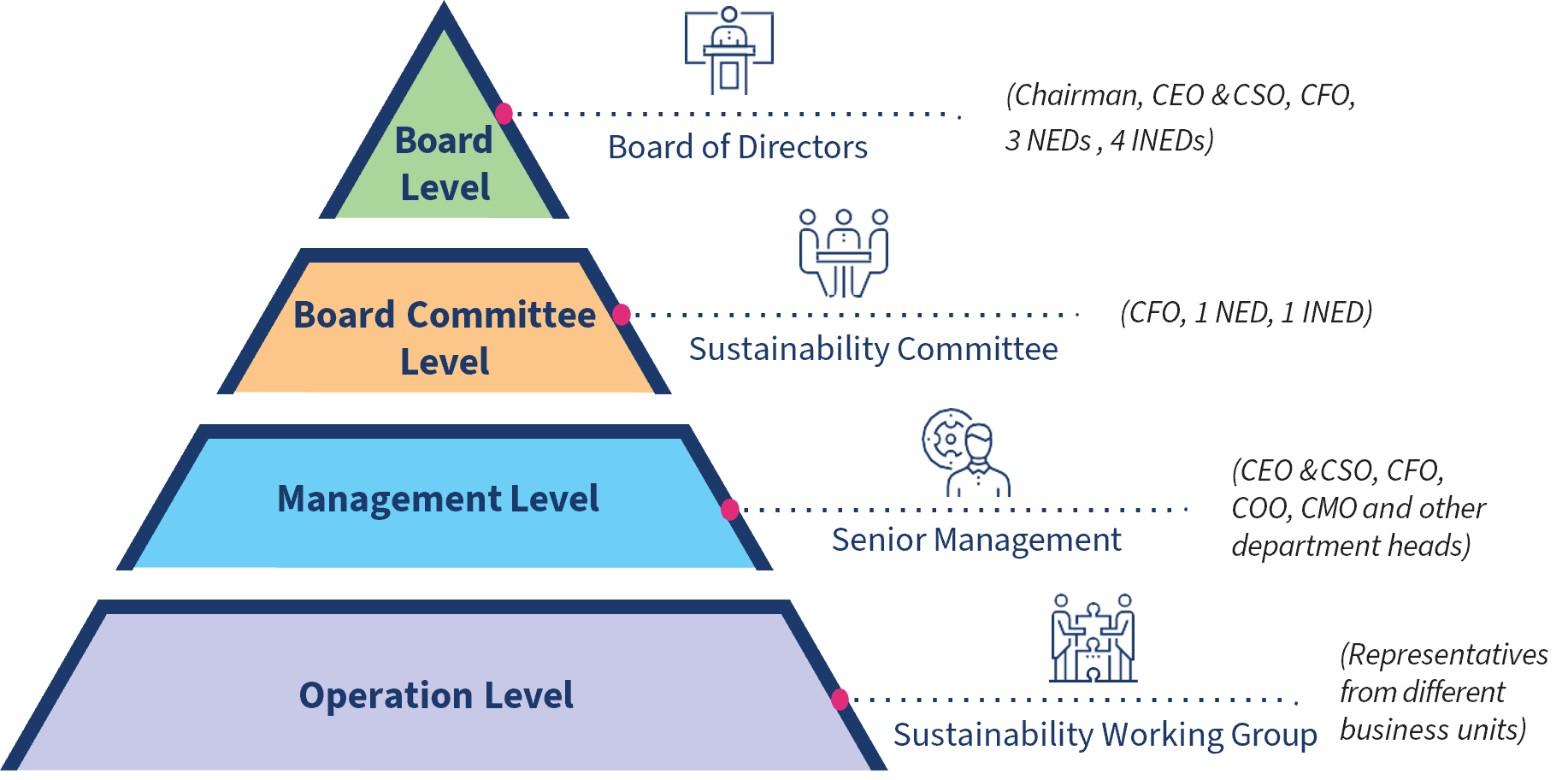

Sustainability Governance

A robust sustainability governance structure is crucial for the long-term sustainable development of the Group. Our four-tier sustainability governance framework reflects the workflow of group-wide sustainability initiatives.

Our Five Sustainability Pillars

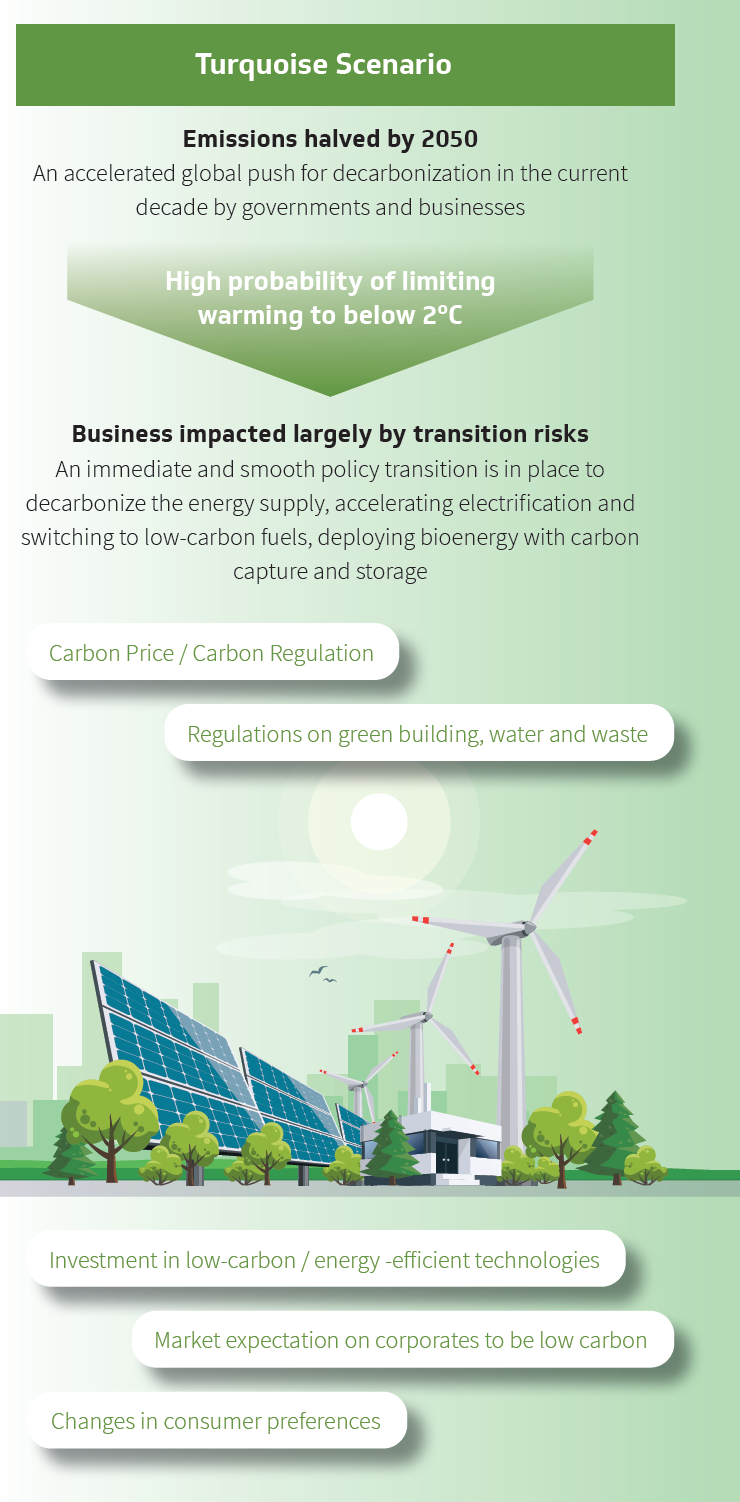

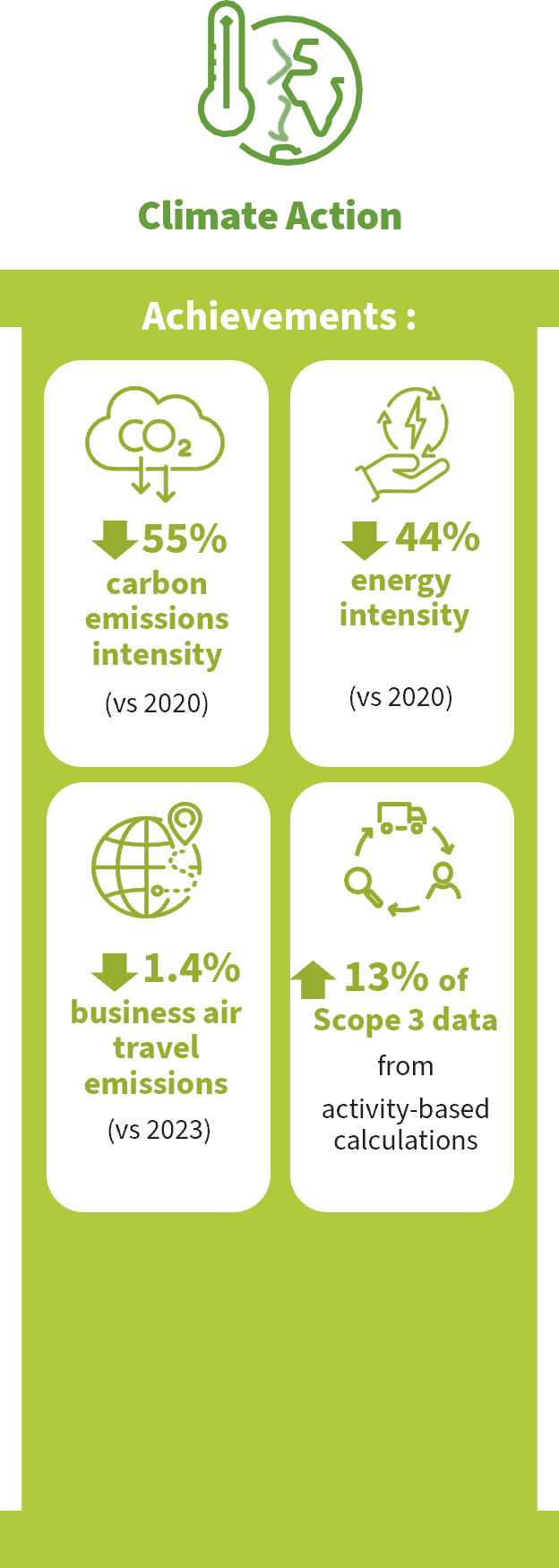

We took proactive efforts to building climate resilience by conducting a comprehensive climate risk assessment to identify climate-related risks and opportunities that impact our business in 2022.

The climate risk assessment of our key operational locations (Shanghai, Suzhou, Hong Kong and U.S) covered an analysis of climate-related, including both physical and transition risks, alongside the potential financial impact under two science-based climate scenarios: one where average temperature increases by 4° C (Brown scenario) and one where average temperature increases are kept to below 2° C (Turquoise scenario). Scenario analysis helps develop strategic plans in identifying climate related risks and opportunities. The Brown and Turquoise scenarios are two consistent, high-contrast, balanced, and science-based scenarios were used to assess plausible impacts of climate transition on the business over time. The scenarios were informed by the data sets of the globally recognized Intergovernmental Panel on Climate Change (IPCC), Network of Central Banks and Supervisors for Greening the Financial System (NGFS) and International Energy Agency (IEA), and enhanced with granular, location-specific research.

The identification and assessment of climate-related risks has been integrated to our existing risk management framework for improvement in the integration of sustainability risks. For the physical and transitional risks identified, please refer to Action on Climate Risks in 2022 Sustainability Report.

In 2023, we stepped up our commitment and efforts to address the sustainability risks and achieve the relevant targets set building on the climate risk assessment conducted in 2022. We maintain continuous monitoring of the identified risks to stay informed and responsive to changes in the risk landscape, and to ensure our strategies and initiatives align with our sustainability objectives.

In 2024, we took another significant step forward in translating climate risks into quantifiable financial impacts. Building on the risk identification work conducted in previous years, we developed a calculation model by referencing proxy factors from reputable papers and databases. We collected demographic information about our operating sites and conducted several sample calculations to assess the financial impact of physical risks such as extreme heat, extreme precipitation, and flooding, as well as transition risks such as increases in carbon prices.

In 2025, we will further refine this model to accurately assess the potential financial impacts as well as the most feasible mitigation measures to prevent the climate impact from materializing. This proactive approach not only enhances our financial planning but also positions us to better navigate the complexities of a changing climate.

For more details of our TCFD disclosure, please refer to here.

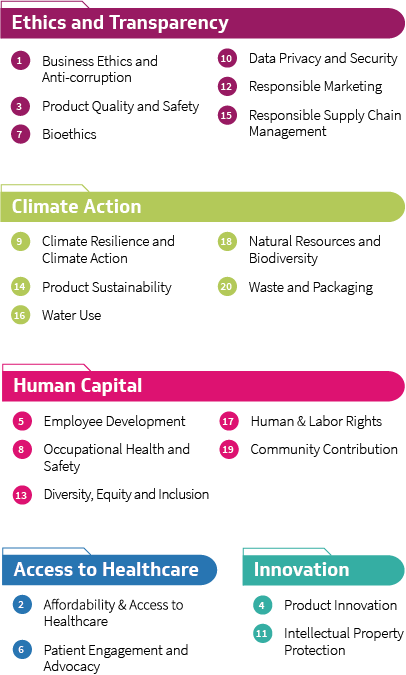

We conducted a comprehensive materiality assessment with both internal and external stakeholders by means of online surveys, focus group meetings and deep dive interviews to identify 33 ESG material topics in 2022. Please see the summary in the next section below or refer to P.23-27 of our 2022 Sustainability Report to understand more on our stakeholder-driven materiality approach, key stakeholder groups and format of engagement, stakeholders’ concerns and our response.

In 2023, we took into account insights from the SASB materiality topics for the pharmaceutical industry, peer benchmarking and global trends in sustainability along with a review of the materiality assessment results from 2022. As a result, we have reorganized and consolidated the material topics, condensing the 33 topics to 20. This facilitates our prioritization of the most relevant sustainability issues that have a significant impact on our business and stakeholders.

In 2024, we considered our 20 material topics, which continued to retain their relevance and importance to both our business and stakeholders, should remain unchanged. This materiality consistency enables us to track our work progress, measure impact, and refine our sustainability strategy effectively.

OUR MATERIAL TOPICS

The materiality matrix maps 20 ESG material issues, with their importance to external stakeholders plotted on the y-axis and their importance to our business continuity and development plotted on the x-axis. Overall materiality was determined by the aggregate score assigned to each ESG material issue by our internal and external stakeholders. All material issues have been addressed in this Report in accordance with the various reporting standards. The top five material issues to internal and external stakeholders have been identified as Business Ethics and Anti-Corruption, Affordability and Access to Healthcare, Product Quality and Safety, Product Innovation, and Employee Development. The rankings are outlined in the following materiality matrix.

OUR STAKEHOLDER-DRIVEN MATERIALITY APPROACH

We believe that material issues should be prioritized to ensure our efforts remain focused on those areas where we can have the greatest impact and be in a better position to anticipate evolving sustainability trends. Getting a better understanding of our sustainability position and the insights collected can help us in embedding sustainability practices into our operations. We follow a four-phased approach to assessing materiality: 1) Issue Identification; 2) Identifying Stakeholders and Format of Engagement; 3)Prioritization; and 4) Evaluation and Validation.

Step 1: Issue Identification

We first identified an initial list of sustainability topics that are potentially relevant to HUTCHMED. This study included a review of our material topics list disclosed in our 2020 and 2021 Sustainability Reports against the sustainability industry landscape, global and local sustainability megatrends, peer benchmarking, as well as emerging regulatory developments which can have an impact on HUTCHMED’s business. Considerations were also given to sustainability topics and rating requirements of various international sustainability standards and frameworks, ESG reporting guides published by the HKEX, the LSE Group and the Nasdaq Stock Exchange, and the UN SDGs.

Step 2: Identifying Stakeholders and Format of Engagement

Our stakeholders have been defined as groups on which our business has a significant impact on, and those with a vested interest in our operations. We proactively engaged for deeper stakeholder relationships, not only to strengthen communication with key stakeholders but also to inform them of HUTCHMED’s efforts and plans on our sustainability development through appropriate channels.

Of the stakeholders involved, internal stakeholders include management representatives of significant business units, while external stakeholders include general employees, investors, customers, suppliers, business partners, NGO partners and communities, media, industry associations and academia, government and regulators.

With reference to the AA1000 Stakeholder Engagement Standard, stakeholder selection was based on the criteria of necessity, diversity, willingness to participate, influence and dependence on HUTCHMED.

Step 3: Prioritization

Following the identification stage, we engaged our stakeholders through an online survey as well as stakeholder interviews to provide feedback on our priorities and performance. Approximately 2,400 responses with a total response rate of 44% to our online surveys from both internal and external stakeholders on the importance and relevance of a list of predetermined sustainability issues were assessed by our independent third-party consultant.

In order to reach a deeper understanding from our stakeholders, we have also conducted 6 focus groups and 4 one-on-one deep dive interviews with a total of 25 key stakeholders, including employees, investors, suppliers, business partners, and subject matter experts. The interviews enabled us to pinpoint the critical areas and steer resources to support the business strategies of the Group.

Step 4: Evaluation and Validation

According to the methodology of AA1000’s materiality process, 33 critical and highly material issues were prioritized, and further validated. The outcome of the materiality review, which comprises the identified issues, along with the perception of sustainability, trends and opportunities was reported and discussed at both the Sustainability Committee meeting and the Board Meeting. The assessed aggregated results were reviewed and approved by senior management, the board-level Sustainability Committee, and the Board.

Ratings and Awards

Major Ratings

| Ratings | Rating Date | Current Rating/Scores | Previous Rating/Scores |

| MSCI ESG | Sep 2024 | A | BBB |

| S&P Global ESG | Aug 2024 | 53/100 (93rd percentile) |

49/100 (90th percentile) |

| Sustainalytics | Jul 2025 | 26.0 (Medium Risk) |

27.3 (Medium Risk) |

| ISS ESG | Feb 2025 | C+ (Prime) |

C |

| HSI / HKQAA | Aug 2024 | A- | BBB+ |

| CDP | Feb 2025 | Climate : C Water Security : C Supplier Engagement : B- |

N/A |

Sustainable Development Goals

Our actions support the following United Nations Sustainable Development Goals:

Feedback

We highly value your opinions on our sustainability performance and strategies. Please send us your comments through: info@hutch-med.com

2023 Report

2023 Report 2022 Report

2022 Report 2021 Report

2021 Report 2020 Report

2020 Report