- Chi-Med

- News & Presentations

- | Announcements & Press Releases

HUTCHMED Reports 2025 Interim Results

— Indications expansion driving growth and ATTC platform enriching pipeline —

— $455 million in net income attributable to HUTCHMED driven by non-core partial disposal —

Hong Kong, Shanghai & Florham Park, NJ — Thursday, August 7, 2025: HUTCHMED (China) Limited (“HUTCHMED”, the “Company” or “we”) (Nasdaq/AIM:HCM; HKEX:13) today reports its financial results for the six months ended June 30, 2025 and provides updates on key clinical and commercial developments.

HUTCHMED to host results webcasts today at 8:00 a.m. EDT / 1:00 p.m. BST / 8:00 p.m. HKT in English on Thursday, August 7, 2025, and tomorrow at 8:30 a.m. HKT in Chinese (Putonghua) on Friday, August 8, 2025. After registration, investors may access the live webcast at www.hutch-med.com/event.

All amounts are expressed in US dollars unless otherwise stated. A list of abbreviations is in the Glossary at the end of the page.

Global commercial progress and delivery of sustainable growth

- ORPATHYS® (savolitinib) secured China approval of its third lung cancer indication for EGFRm NSCLC patients with MET amplification after progression on EGFR inhibitor treatment in combination with TAGRISSO® (osimertinib) on June 30, 2025, in time to be eligible for potential national reimbursement negotiation towards the end of this year. This combination offers the only oral, chemotherapy-free approach to a sizable percentage (~30%) of these patients. The approval triggered a $11.0 million milestone payment from AstraZeneca which markets both ORPATHYS® and TAGRISSO®.

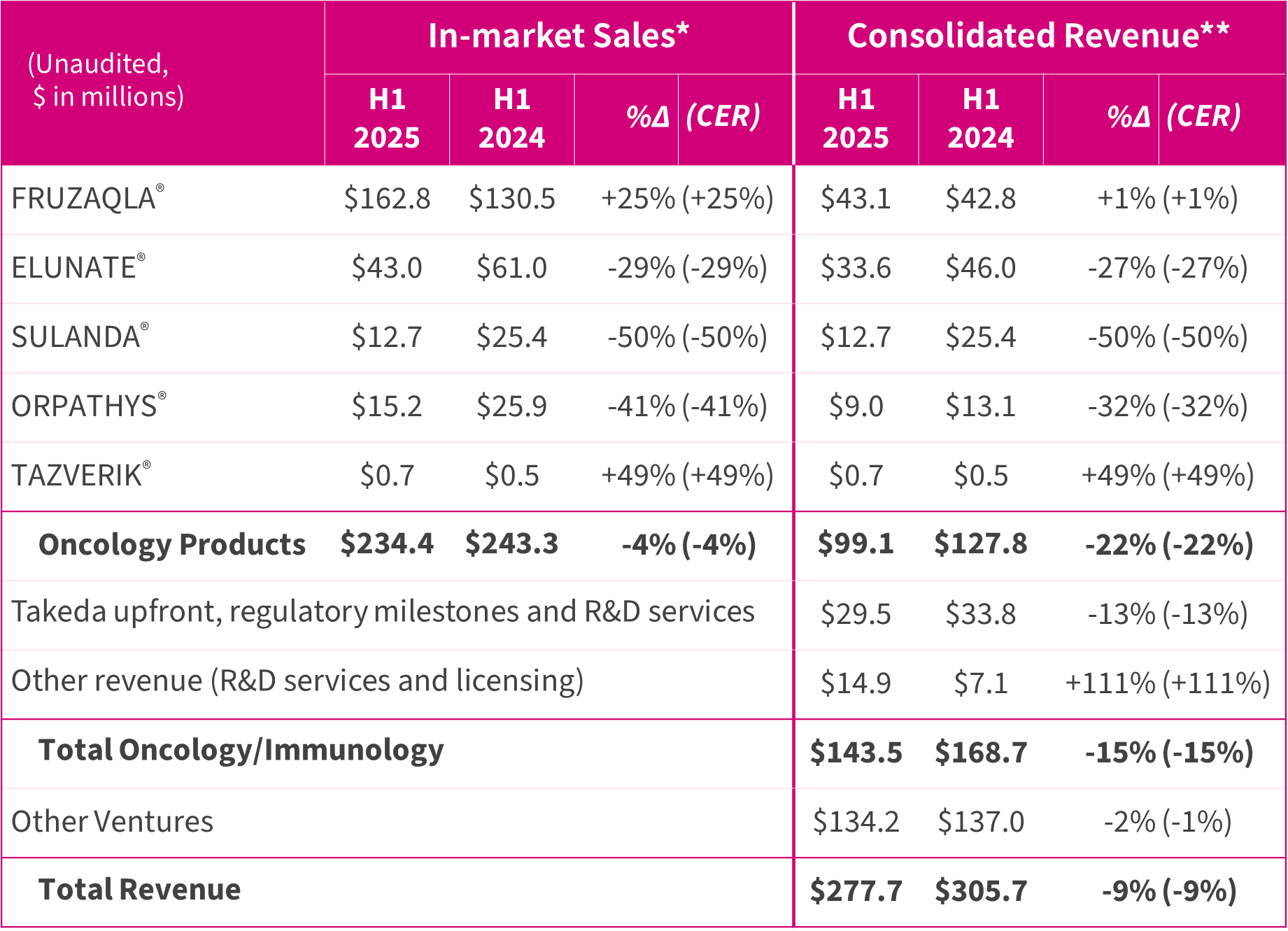

- FRUZAQLA® (fruquintinib ex-China) in-market sales by Takeda were up 25% to $162.8 million (H1-24: $130.5m) as its geographical coverage expanded to more than 30 countries. ELUNATE® (fruquintinib China) achieved $43.0 million (H1-24: $61.0m) reflecting intensifying competitive pressures and streamlining of our salesforce structure, but growth has returned recently. Total Oncology/Immunology consolidated revenue, including milestone and service income, was $143.5 million (H1-24: $168.7m).

- Net income attributable to HUTCHMED of $455.0 million was achieved in the first half of 2025 (H1-24: $25.8m), with a cash balance of $1.36 billion as of June 30, 2025, significantly boosted by a $416.3 million divestment gain, net of tax from the disposal of a partial equity stake in a non-core joint venture and divestment proceeds.

Pipeline progress and new technology platform

- Positive results from the SACHI China and SAVANNAH global lung cancer trials of ORPATHYS® in combination with TAGRISSO® were presented at ASCO and ELCC conferences. SACHI showed mPFS of 8.2 months with this oral combination compared to 3.0 months with chemotherapy, and SAVANNAH showed 7.4 months with this oral combination. This is the only treatment option that demonstrated statistically significant results in a biomarker-directed pivotal clinical trial in MET amplified, EGFR TKI refractory NSCLC patients. Enrollment in the SAFFRON global Phase III trial is expected to complete in the second half of this year and readout in the first half of 2026.

- Phase II/III trial on SULANDA® (surufatinib) in combination with AiRuiKa® (camrelizumab) and chemotherapy for previously-untreated metastatic pancreatic cancer patients is progressing well, targeting data readout in the second half of 2025. An earlier study presented promising updated data at ASCO with ORR of 51.1% (vs 24.4% with chemotherapy) and mPFS of 7.9 months (vs 5.4 months).

- Positive FRUSICA-2 Phase III results supported the China approval submission for ELUNATE® with TYVYT® (sintilimab) in previously-treated kidney cancer. Details to be presented at ESMO Congress. Prior Phase Ib/II study showed ORR of 60.0% and mPFS of 15.9 months.

- New Antibody-Targeted Therapy Conjugates (ATTC) platform drug candidates have been selected, planning to enter clinical development in late 2025. We also plan to present pre-clinical data at a scientific conference before the end of this year. Successful development of multiple ATTC molecules is expected to lead to collaboration and licensing opportunities in the future. Initial responses from potential partners are very positive.

Dr Dan Eldar, Non-executive Chairman of HUTCHMED, said, “With a strong balance sheet, robust operations and an exciting new ATTC platform, HUTCHMED is ready to enter a new phase of growth. Partnering is still a strategic focus, with multinational pharmaceutical companies remaining favorable towards such licensing opportunities with China biotech companies. In recent months we have seen markets’ sentiment and performance have significantly improved. China domestic drug policy and pricing environment also manifest strengthened support for innovative drug development, with the potential introduction of a commercial insurance drug list later this year, targeting a diversified, multi-layered healthcare social security payment system down the road.

We intend to prudently and actively deploy resources to expedite the development of a series of drug candidates from our novel ATTC platform, including synchronous clinical development in China and overseas. Our 20 years of knowledge of in-house discovery, experience in running large-scale pivotal trials, collaboration with international partners and success in obtaining global regulatory approvals empower us to bring forth more innovative medicines to address large unmet needs around the world.”

Dr Weiguo Su, Chief Executive Officer and Chief Scientific Officer of HUTCHMED, said, “We concluded the first half of 2025 with several important milestones achieved, some earlier than expected. The presentation of SACHI data at ASCO in a late-breaking oral presentation at the beginning of June was impressive, validating both the clinical strength and commercial advantages of ORPATHYS® in the market. This is the first biomarker-selected pivotal study globally for EGFR TKI refractory lung cancer patients, demonstrating clear clinical benefits for these patients. The China approval of ORPATHYS® at the end of June for this indication, six months after filing acceptance, was ahead of schedule and in time to qualify for national reimbursement negotiation. Also in June, the third indication of ELUNATE® for kidney cancer was accepted for review by the NMPA, supported by positive data in the FRUSICA-2 Phase III trial, to be presented at ESMO Congress. We also launched TAZVERIK® (tazemetostat), our first hematological oncology drug, in July following approval in March.

We believe sales growth should improve in second half of 2025, with the help of indication expansion in China and better market penetration overseas. In the near term, we shall start clinical development of multiple drug candidates from our ATTC program, a crucial technology platform, which will enrich our pipeline and provide ample partnership opportunities.”

2025 Interim Results & Business Updates

I. COMMERCIAL OPERATIONS

FRUZAQLA® in-market sales by Takeda were up 25% in the first half of 2025 at $162.8 million, driven by strong growth following approvals in more than 30 countries to date, including over 10 new markets in 2025. Reimbursement was received in the US, Spain and Japan last year, and, in July 2025, positive recommendation was received for NHS reimbursement in England and Wales.

The China pharmaceutical sector has gone through multifaceted changes. To position HUTCHMED for sustainable long-term growth, HUTCHMED has streamlined its sales force to establish a more efficient commercial organization and enhance productivity. In the face of intensifying competition as its products mature, HUTCHMED has strengthened its strategy to continue to focus on science-driven commercial activities to further differentiate its products. In the first half of 2025, in-market sales in China for ELUNATE®, SULANDA® and ORPATHYS® decreased as compared to the first half of 2024, reflecting competition and the transitional effects of the changes in our sales team and marketing strategy.

Total in-market sales were down 4%. Consolidated revenue dropped 22% due to lower China in-market sales, offset by flat FRUZAQLA® revenue.

Other Oncology/Immunology revenue, consisting of upfront or milestones, R&D services and licensing to our partners increased 9% to $44.4 million. Revenue from Other Ventures, comprising prescription drug distribution, remained flat, leading to total consolidated revenue of $277.7 million, down 9%.

* FRUZAQLA®, ELUNATE® and ORPATHYS® mainly represent total sales to third parties as provided by Takeda, Eli Lilly and AstraZeneca, respectively.

** FRUZAQLA® represents manufacturing revenue and royalties paid by Takeda; ELUNATE® represents manufacturing revenue, promotion and marketing services revenue and royalties paid by Eli Lilly to HUTCHMED, and sales to other third parties invoiced by HUTCHMED; ORPATHYS® represents manufacturing revenue and royalties paid by AstraZeneca to HUTCHMED and sales to other third parties invoiced by HUTCHMED; SULANDA® and TAZVERIK® represent the HUTCHMED’s sales of the products to third parties.

II. REGULATORY UPDATES

- Savolitinib sNDA approved by the NMPA for 2L EGFRm NSCLC patients with MET amplification, in combination with TAGRISSO®, triggering $11.0 million milestone from AstraZeneca, in June 2025.

- Savolitinib sNDA approved by the NMPA for 1L and 2L (converted from conditional to full approval) METex14 NSCLC in January 2025. Savolitinib approved in Hong Kong for METex14 NSCLC under the 1+ Mechanism in February 2025.

- Tazemetostat NDA conditionally approved by the NMPA for 3L R/R follicular lymphoma with EZH2 mutation in March 2025.

III. LATE-STAGE CLINICAL DEVELOPMENT ACTIVITIES

Savolitinib (ORPATHYS® in China), a highly selective oral inhibitor of MET

- Presented SACHI China Phase III results at ASCO 2025 for 2L EGFRm NSCLC patients with MET amplification, in combination with TAGRISSO®, showing mPFS of 8.2 months compared to 4.5 months with chemotherapy in ITT population (HR 0.34), and 6.9 months compared to 3.0 months in post third-generation EGFR TKI-treated subgroup (HR 0.32, both p<0.0001) (NCT05015608).

- Presented SAVANNAH global Phase II results at ELCC 2025 for 2L EGFRm NSCLC patients with MET amplification or overexpression, in combination with TAGRISSO®, showing ORR of 56%, mPFS of 7.4 months and mDoR of 7.1 months (NCT03778229).

- Continued enrolling SAFFRON global Phase III study for 2L EGFRm NSCLC patients with MET amplification or overexpression (NCT05261399) and the study will potentially support global filings; and SANOVO China Phase III study for 1L EGFRm NSCLC patients with MET overexpression (NCT05009836).

- Completed enrollment of China Phase II registrational study for 3L gastric cancer patients with MET amplification (NCT04923932).

Potential upcoming clinical milestones for savolitinib:

- Complete SAFFRON Phase III enrollment in the second half of 2025, data readout in the first half of 2026.

- Complete SANOVO China Phase III enrollment in the second half of 2025.

Fruquintinib (ELUNATE® in China, FRUZAQLA® outside of China), a selective oral inhibitor of VEGFR

- Positive results of FRUSICA-2 China Phase III in 2L RCC in March 2025 (NCT05522231).

- Presented China Phase II IIT results at AACR, in combination with TUOYI® (toripalimab) or TYVYT®, in 2L and above MSS/pMMR CRC, showing mPFS of 13.2 months and mOS of 29.0 months (NCT04483219).

Sovleplenib (HMPL-523), an investigative and highly selective oral inhibitor of Syk

- Ongoing ESLIM-01 ITP NMPA NDA review stipulates a lower impurity limit, requiring further manufacturing validation and stability test. Target re-submission in first half of 2026, with additional data rolling in during second half of 2026. In the future, the company will look to continue overseas development.

- Published China Phase II results in warm AIHA in China at EHA and in The Lancet Haematology in 2025, demonstrating overall response rate of 66.7% and a favorable safety profile (NCT05535933).

- Completed ESLIM-02 China Phase III enrollment for warm AIHA in June 2025 (NCT05535933).

Potential upcoming regulatory milestones for sovleplenib:

- ESLIM-01 NMPA NDA re-submission in first half of 2026 (NCT05029635).

- ESLIM-02 NMPA sNDA submission in first half of 2026 (NCT05535933).

Surufatinib (SULANDA® in China), an oral inhibitor of VEGFR, FGFR and CSF-1R

Potential upcoming clinical milestone for surufatinib:

- Data readout of Phase II part of a China Phase II/III HUTCHMED-sponsored trial for 1L metastatic PDAC patients, in combination with AiRuiKa®, nab-paclitaxel and gemcitabine in late 2025 (NCT06361888).

Tazemetostat (TAZVERIK® in China), a first-in-class, oral inhibitor of EZH2

- TAZVERIK® NDA approved by the NMPA for 3L R/R follicular lymphoma with EZH2 mutation.

- Continued enrolling SYMPHONY-1 China portion of the Phase III portion of the global study, in combination with lenalidomide and rituximab, in 2L follicular lymphoma patients (NCT04224493).

Fanregratinib (HMPL-453), a novel, highly selective and potent inhibitor targeting FGFR 1, 2 and 3

- Completed enrollment of China Phase II registrational trial for IHCC with FGFR fusion / rearrangement in February 2025 (NCT04353375).

Ranosidenib (HMPL-306), an investigative and highly selective oral dual-inhibitor of IDH1 and IDH2 enzymes

- Continued enrolling RAPHAEL China Phase III trial for 2L R/R IDH1/2-mutant AML (NCT06387069).

IV. ANTIBODY-TARGETED THERAPY CONJUGATE (ATTC) PLATFORM

New in-house created platform with multiple potential IND candidates

HUTCHMED plans to initiate China and global clinical trials for our first ATTC drug candidate around the end of 2025, followed by multiple global IND filings for more ATTC candidates in 2026.

Our ATTC next-generation technology platform leverages over 20 years of expertise in targeted therapies with small molecules inhibitors. By linking a monoclonal antibody with a proprietary targeted small-molecule inhibitor (SMI) payload, our ATTC platform has the capability to derive multiple drug candidates targeting various oncology indications, including precision medicine against selective sub-types. These ATTC drug candidates enrich the next wave of clinical development with potential key advantages over traditional antibody-drug conjugates and/or small molecule medicines.

- Better efficacy through synergistic antibody-small molecule targeted therapy combinations that will target specific mutations; overcome drug resistance to existing treatment.

- Improved safety and prolonged treatment given lower off-tumor or off-target toxicity than small molecules, lower risk of myelosuppression and better safety than cytotoxin-based conjugates.

- Attractive pharmacokinetics tackles difficult drug targets, enabled by antibody-guided delivery to target sites which will improve bioavailability and reduce drug-drug interactions.

- Advantages over existing ADCs due to lower off-tumor toxicities from the SMI payload, released through lysosomal cleavage inside target cells, targets cell signaling pathway driven by mutation specific to tumor cells. It can be used in combination with established standard therapies such as chemotherapy and immunotherapy to further enhance efficacy.

- Potential first-line applications, as chemo-free ATTC can potentially support combinations with other targeted therapies, chemotherapy and immunotherapy, in early-line settings with broad market potential.

V. COLLABORATION UPDATES

Further progress of candidate IMG-007, discovered by HUTCHMED

- ImageneBio, Inc. (Nasdaq: IMA) – Inmagene and Ikena Oncology, Inc. completed a merger on July 25, 2025 and ImageneBio, Inc., the merged entity, holds the license rights to IMG-007 granted by HUTCHMED. HUTCHMED has an approximate 3.67% shareholding in ImageneBio, Inc.

- Announced positive results of a US/Canada Phase IIa study of IMG-007 for atopic dermatitis in April 2025, showing week 16 mean change in EASI of 77% and EASI-75 response of 54% (NCT05984784).

- Dosed the first patient in a US Phase IIb randomized, double-blind, placebo-controlled dose-finding study of IMG-007 for moderate-to-severe atopic dermatitis in July 2025, targeting to enroll 220 patients who have had inadequate response to and/or intolerance of topical therapies (NCT07037901).

- Announced positive results of a US/Canada Phase IIa study of IMG-007 for severe alopecia areata in January 2025, showing mean reduction from baseline in Severity of Alopecia Tool (SALT) score of 30.1% by week 36 (NCT06060977).

VI. OTHER VENTURES

- Other Ventures consolidated revenue, predominantly from the prescription drug distribution business in China, were steady at $134.2 million for the six months ended June 30, 2025.

- HUTCHMED divested a 45.0% equity interest in SHPL for $608.5 million in cash in April 2025, retaining a 5.0% equity interest. A divestment gain, net of tax of $416.3 million was recognized during the first half of 2025. As a result, HUTCHMED’s share of equity in earnings of SHPL decreased to $23.1 million for the six months ended June 30, 2025.

- Consolidated net income attributable to HUTCHMED from Other Ventures increased to $440.3 million (H1-24: $34.1m), primarily due to the SHPL interest disposal.

VII. SUSTAINABILITY

In April 2025, the 2024 Sustainability Report was published, highlighting the progress made in 11 goals and targets and enhanced climate actions, including improved Scope 3 data, tightened control over air travel and engagement with suppliers. This year, a comprehensive climate risks assessment is being conducted to further understand and quantify the potential financial impacts of climate change, including physical risks brought by flooding and heat stress, and transition risks for HUTCHMED under optimistic and pessimistic scenarios.

HUTCHMED has made notable progress in its ESG ratings, including ratings from CDP Worldwide, the Hang Seng Corporate Sustainability Index Series, ISS ESG, MSCI ESG, Sustainalytics, and S&P Global ESG. In May 2025, HUTCHMED ranked third in ESG Excellence in the Healthcare, Pharmaceutical, and Biotechnology sector in the Extel’s Asia Executive Team survey, reflecting feedback from over 5,400 portfolio managers and analysts. Extel ranked HUTCHMED as one of the Most Honored Companies; ranked it first in Best Board of Directors, Best CEO, Best IR Program and Best IR Professionals; as well as second in Best CFO and Best IR Team in the Healthcare, Pharmaceutical, and Biotechnology sector.

Financial Highlights

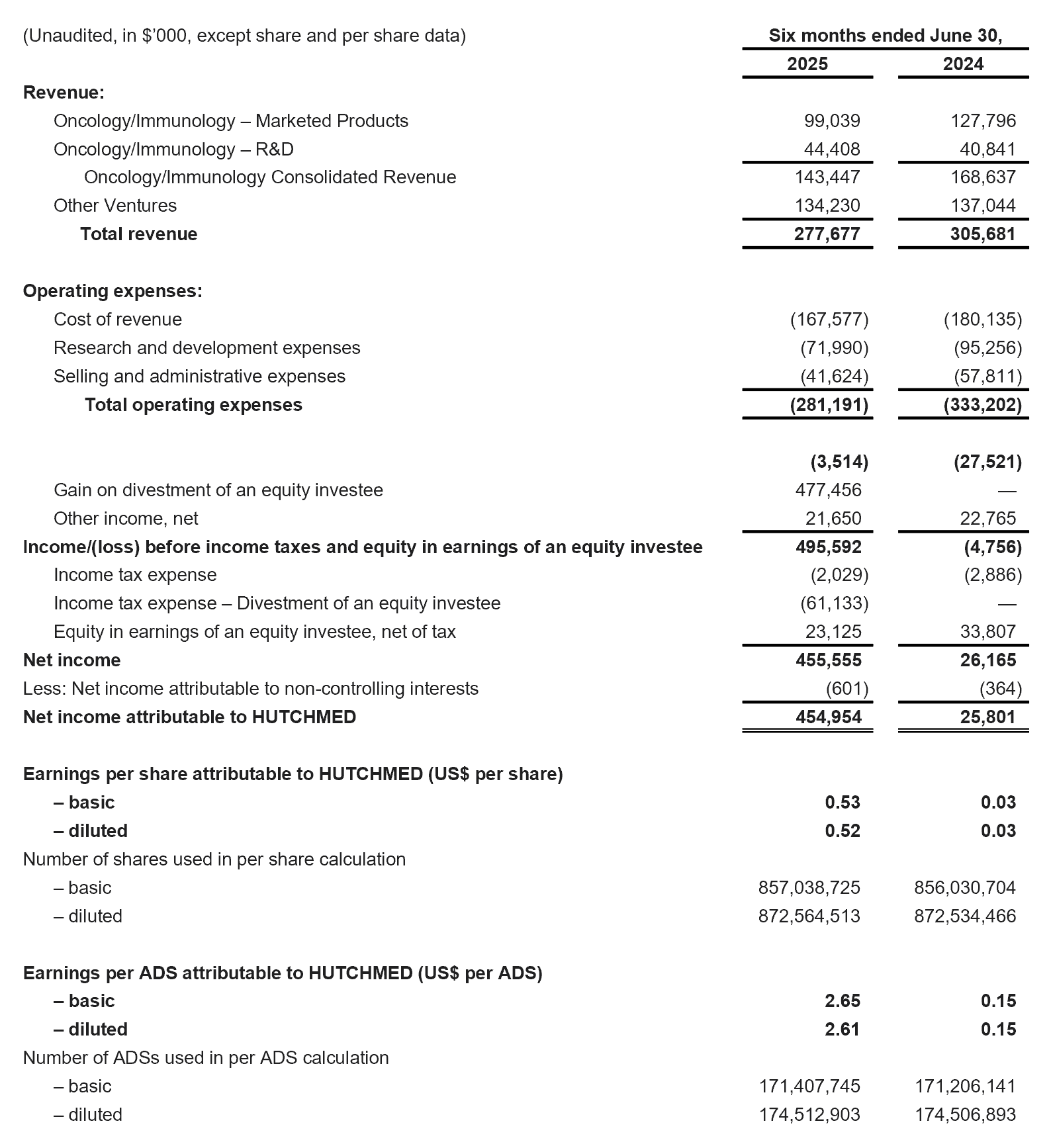

Revenue for the six months ended June 30, 2025 was $277.7 million compared to $305.7 million for the six months ended June 30, 2024.

- Oncology/Immunology consolidated revenue amounted to $143.5 million (H1-24: $168.7m):

- FRUZAQLA® revenue was $43.1 million (H1-24: $42.8m), reflecting continued growth in royalties, offset by reduced manufacturing revenue compared to its launch year. In-market sales by Takeda were $162.8 million (up 25%) driven by strong growth following approvals in more than 30 countries to date, including over 10 new markets in 2025.

- ELUNATE® revenue decreased to $33.6 million (H1-24: $46.0m) in its seventh year since launch, comprising manufacturing revenue, promotion and marketing services revenue and royalties. In-market sales decreased to $43.0 million, reflecting the intensifying competitive pressures from combination therapies of key competing products and their additional generics and biosimilars entry in 3L CRC. The launch of the entry of the new indication 2L EMC in 2025 and continuous inclusion of ELUNATE® in key guidelines are expected to drive future growth.

- SULANDA® revenue decreased to $12.7 million (H1-24: $25.4m) in the face of strong competition for NET patients from new somatostatin analogues drugs with their inclusion in the NRDL and broader coverage. To counteract this challenge, we continue to drive awareness and product differentiation to uphold SULANDA® position in TKI.

- ORPATHYS® revenue decreased to $9.0 million (H1-24: $13.1m) on in-market sales of $15.2 million, impacted by the launch and NRDL inclusion of several competing drugs for METex14 skipping Such results have not reflected expected growth from the recent approval for the much larger EGFR TKI-refractory, MET-amplified NSCLC patient population at the end of June 2025.

- TAZVERIK® revenue was $0.7 million (H1-24: $0.5m) mainly from sales in Hainan and Hong Kong. Launched in mainland China in July 2025 following its approval in March 2025.

- Takeda upfront, regulatory milestones and R&D services revenue were $29.5 million (H1-24: $33.8m), of which $26.6 million was recognized from Takeda deferred revenue.

- Other revenue of $14.9 million (H1-24: $7.1m), includes regulatory milestone of $11.0 million from AstraZeneca following China NDA approval for ORPATHYS® combined with TAGRISSO®.

- Other Ventures consolidated revenue of $134.2 million (H1-24: $137.0m) remained flat.

Net Expenses for the six months ended June 30, 2025 were $239.0 million compared to $279.9 million for the six months ended June 30, 2024, reflecting strong cost control efforts.

- Cost of Revenue decreased 7% to $167.6 million (H1-24: $180.1m), which was mainly due to lower Oncology/Immunology revenue. Cost of revenue as a percentage of oncology product revenue remained stable at 39% (H1-24: 38%).

- R&D Expenses reduced by 24% to $72.0 million (H1-24: $95.3m). While R&D investment outside of China reduced to $7.6 million (H1-24: $14.9m) as we continued to integrate our global R&D operations with China, the decrease was mainly driven by China with R&D investment of $64.4 million (H1-24: $80.4m) reflecting lower costs from completed studies which are under NDA review (e.g. ELUNATE® in 2L RCC) or already led to NMPA approval in H1-25 (e.g. ORPATHYS® in 2L NSCLC). Joint China and global clinical development effort ongoing to gear up for multiple drug candidates from our ATTC

- S&A Expenses were $41.6 million (H1-24: $57.8m). The decrease was mainly due to a reduction in S&A expenses for oncology products which was $13.4 million or 13.5% of oncology product revenue (H1-24: $25.1 million or 19.6%) as sales force structure was streamlined and tighter spending controls imposed.

- Other Items generated net income of $42.2 million (H1-24: $53.3m), mainly comprised of equity in earnings of SHPL, interest income and expense, foreign exchange and taxes. The decrease was primarily due to lower share of equity in earnings of SHPL at $23.1 million (H1-24: $33.8m) as our share decreased to 5% (H1-24: 50%) after the divestment of a partial stake in SHPL completed in April 2025.

Gain on divestment of SHPL, net of tax was $416.3 million for the six months ended June 30, 2025.

Net Income attributable to HUTCHMED for the six months ended June 30, 2025 was $455.0 million compared to $25.8 million for the six months ended June 30, 2024.

- The net income attributable to HUTCHMED for the six months ended June 30, 2025 was $0.53 per ordinary share / $2.65 per ADS (H1-24: $0.03 per ordinary share / $0.15 per ADS).

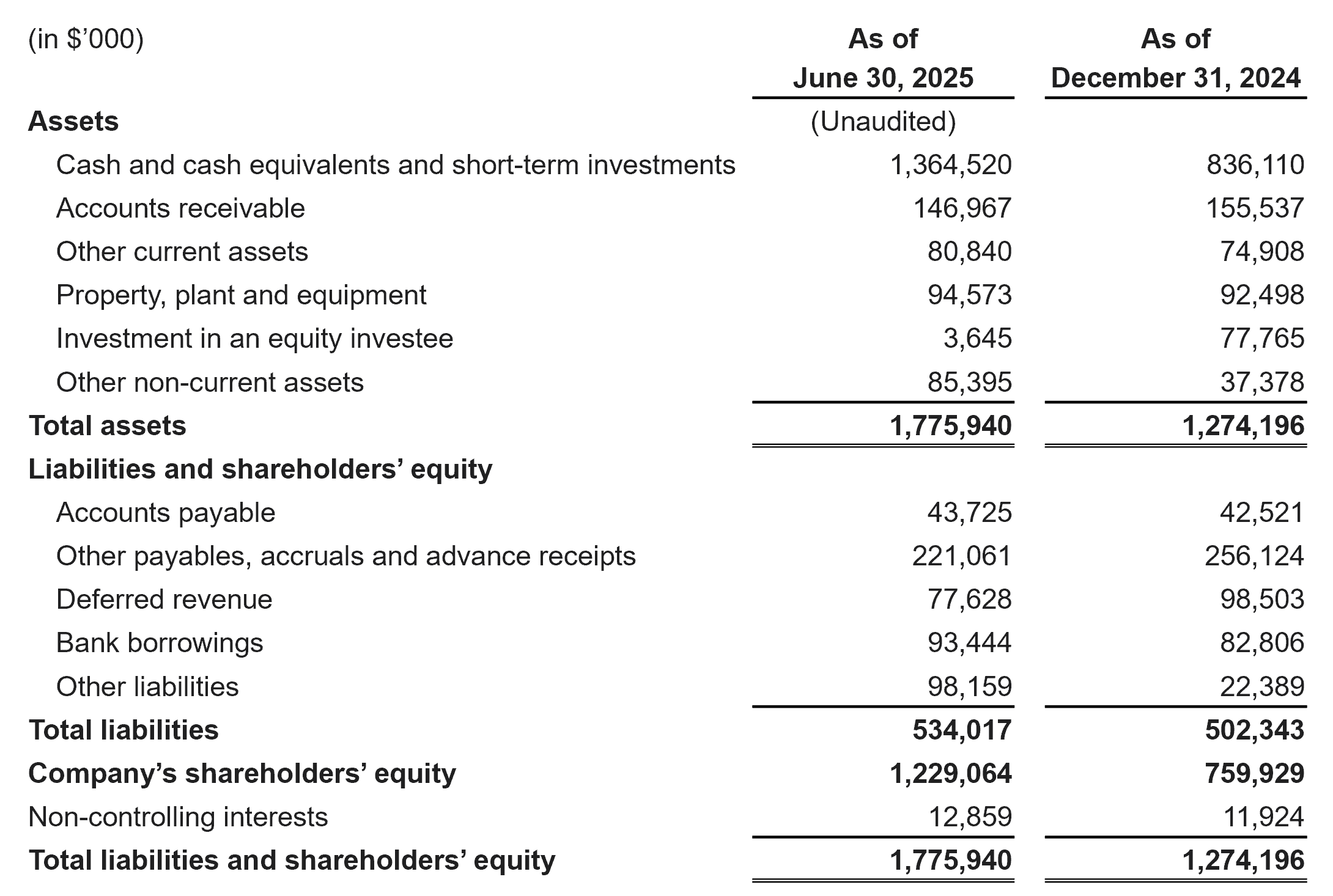

Cash, Cash Equivalents and Short-Term Investments were $1,364.5 million as of June 30, 2025 compared to $836.1 million as of December 31, 2024.

- Adjusted Group (non-GAAP) net cash inflows excluding financing activities in the first half of 2025 were $519.1 million mainly due to the receipt of $608.5 million gross proceeds from the partial divestment of SHPL, offset with the $59.5 million capital gain tax payment for the partial divestment of SHPL, $10.0 million regulatory approval milestone payment and $9.2 million in capital expenditures (H1-24: -$51.3m mainly due to $39.8 million net cash used in operating activities and $10.1 million of capital expenditures).

- Net cash generated from financing activities in the first half of 2025 totaled $9.3 million mainly due to drawdowns of bank borrowings of $8.2 million (H1-24: net cash used in financing activities of $32.6m mainly due to purchases for equity awards of $36.1 million).

Foreign exchange impact: The RMB depreciated against the US dollar on average by approximately 0.8% during the first half of 2025, which has impacted consolidated financial results as highlighted.

FINANCIAL GUIDANCE

HUTCHMED updates full year 2025 guidance for Oncology/Immunology consolidated revenue to $270 million – $350 million due to the phasing of milestone income from partners to 2026 and onwards, as well as the estimated delay of sovleplenib China NDA review completion to after 2025. HUTCHMED will leverage its strong cash resources to accelerate ATTC global development and explore investment opportunities.

Shareholders and investors should note that:

- The Company does not provide any guarantee that the statements contained in the financial guidance will materialize or that the financial results contained therein will be achieved or are likely to be achieved; and

- The Company has in the past revised its financial guidance and reference should be made to any announcements published by it regarding any updates to the financial guidance after the date of publication of this announcement.

———

Use of Non-GAAP Financial Measures and Reconciliation – References in this announcement to adjusted Group net cash flows excluding financing activities and financial measures reported at CER are based on non-GAAP financial measures. Please see the “Use of Non-GAAP Financial Measures and Reconciliation” for further information relevant to the interpretation of these financial measures and reconciliations of these financial measures to the most comparable GAAP measures, respectively.

———

Financial Summary

Condensed Consolidated Balance Sheets Data

Condensed Consolidated Statements of Operations Data

About HUTCHMED

HUTCHMED (Nasdaq/AIM:HCM; HKEX:13) is an innovative, commercial-stage, biopharmaceutical company. It is committed to the discovery and global development and commercialization of targeted therapies and immunotherapies for the treatment of cancer and immunological diseases. Since inception it has focused on bringing drug candidates from in-house discovery to patients around the world, with its first three medicines marketed in China, and the first of which is also approved around the world including in the US, Europe and Japan. For more information, please visit: www.hutch‑med.com or follow us on LinkedIn.

References

Unless the context requires otherwise, references in this announcement to the “Group,” the “Company,” “HUTCHMED,” “HUTCHMED Group,” “we,” “us,” and “our,” mean HUTCHMED (China) Limited and its subsidiaries unless otherwise stated or indicated by context.

Past Performance and Forward-Looking Statements

The performance and results of operations of the Group contained within this announcement are historical in nature, and past performance is no guarantee of future results of the Group. This announcement contains forward-looking statements within the meaning of the “safe harbor” provisions of the US Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by words like “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “pipeline,” “could,” “potential,” “first-in-class,” “best-in-class,” “designed to,” “objective,” “guidance,” “pursue,” or similar terms, or by express or implied discussions regarding potential drug candidates, potential indications for drug candidates or by discussions of strategy, plans, expectations or intentions. You should not place undue reliance on these statements. Such forward-looking statements are based on the current beliefs and expectations of management regarding future events, and are subject to significant known and unknown risks and uncertainties. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those set forth in the forward-looking statements. There can be no guarantee that any of our drug candidates will be approved for sale in any market, that any approvals which have been obtained will continue to remain valid and effective in the future, or that the sales of products marketed or otherwise commercialized by HUTCHMED and/or its collaboration partners (collectively, “HUTCHMED’s Products”) will achieve any particular revenue or net income levels. In particular, management’s expectations could be affected by, among other things: unexpected regulatory actions or delays or government regulation generally; the uncertainties inherent in research and development, including the inability to meet our key study assumptions regarding enrollment rates, timing and availability of subjects meeting a study’s inclusion and exclusion criteria and funding requirements, changes to clinical protocols, unexpected adverse events or safety, quality or manufacturing issues; the delay or inability of a drug candidate to meet the primary or secondary endpoint of a study; the delay or inability of a drug candidate to obtain regulatory approval in different jurisdictions or the utilization, market acceptance and commercial success of HUTCHMED’s Products after obtaining regulatory approval; discovery, development and/or commercialization of competing products and drug candidates that may be superior to, or more cost effective than, HUTCHMED’s Products and drug candidates; the impact of studies (whether conducted by HUTCHMED or others and whether mandated or voluntary) or recommendations and guidelines from governmental authorities and other third parties on the commercial success of HUTCHMED’s Products and drug candidates in development; the ability of HUTCHMED to manufacture and manage supply chains, including various third party services, for multiple products and drug candidates; the availability and extent of reimbursement of HUTCHMED’s Products from third-party payers, including private payer healthcare and insurance programs and government insurance programs; the costs of developing, producing and selling HUTCHMED’s Products; the ability to obtain additional funding when needed; the ability to obtain and maintain protection of intellectual property for HUTCHMED’s Products and drug candidates; the ability of HUTCHMED to meet any of its financial projections or guidance and changes to the assumptions underlying those projections or guidance; the successful disposition of its non-core business; global trends toward health care cost containment, including ongoing pricing pressures; uncertainties regarding actual or potential legal proceedings, including, among others, actual or potential product liability litigation, litigation and investigations regarding sales and marketing practices, intellectual property disputes, and government investigations generally; and general economic and industry conditions, including uncertainties regarding the effects of the persistently weak economic and financial environment in many countries, uncertainties regarding future global exchange rates, uncertainties in global interest rates, and geopolitical relations, sanctions and tariffs. For further discussion of these and other risks, see HUTCHMED’s filings with the US Securities and Exchange Commission, on AIM and on HKEX. HUTCHMED is providing the information in this announcement as of this date and does not undertake any obligation to update any forward-looking statements as a result of new information, future events or otherwise.

In addition, this announcement contains statistical data and estimates that HUTCHMED obtained from industry publications and reports generated by third-party market research firms. Although HUTCHMED believes that the publications, reports and surveys are reliable, HUTCHMED has not independently verified the data and cannot guarantee the accuracy or completeness of such data. You are cautioned not to give undue weight to this data. Such data involves risks and uncertainties and are subject to change based on various factors, including those discussed above.

Inside Information

This announcement contains inside information for the purposes of Article 7 of Regulation (EU) No 596/2014 (as it forms part of retained EU law as defined in the European Union (Withdrawal) Act 2018).

Medical Information

This announcement contains information about products that may not be available in all countries, or may be available under different trademarks, for different indications, in different dosages, or in different strengths. Nothing contained herein should be considered a solicitation, promotion or advertisement for any prescription drugs including the ones under development.

🔻GLOSSARY (click to unfold)🔻

1L = First-line.

2L = Second-line.

3L = Third-line.

AACR = American Association for Cancer Research.

ADC = Antibody-drug conjugate.

ADS = American depositary shares, each of which represents five ordinary shares.

AIHA = Autoimmune hemolytic anemia.

AKT = Protein kinase B.

AML = Acute myeloid leukemia.

ASCO = American Society of Clinical Oncology.

ASH = American Society of Hematology.

AstraZeneca = AstraZeneca AB, a subsidiary of AstraZeneca plc.

ATTC = Antibody-targeted therapy conjugates.

BICR = Blinded independent central review.

BOC = Bank of China Limited.

BTK = Bruton’s tyrosine kinase.

CDP Worldwide = formerly known as the Carbon Disclosure Project.

CER = Constant exchange rate. We also report changes in performance at CER which is a non-GAAP measure. Please refer to “Use of Non-GAAP Financial Measures and Reconciliation” for further information relevant to the interpretation of these financial measures and reconciliations of these financial measures to the most comparable GAAP measures.

CLL = Chronic lymphocytic leukemia.

CNS = Central nervous system.

CR+CRh = Combined complete remission + complete remission with partial hematologic recovery.

CRC = Colorectal cancer.

CSF-1R = Colony-stimulating factor 1 receptor.

DCR = Disease control rate.

DLBCL = Diffuse large B-cell lymphoma.

DoR = Duration of response.

EASI = Eczema area and severity index.

EGFR = Epidermal growth factor receptor.

EGFRm = Epidermal growth factor receptor mutated.

EHA = European Hematology Association.

ELCC = The European Lung Cancer Congress.

Eli Lilly = Lilly (Shanghai) Management Company Limited.

EMC = Endometrial cancer.

epNET = Extra-pancreatic neuroendocrine tumor.

Epizyme = Epizyme, Inc., an Ipsen company.

ERK = Extracellular signal-regulated kinase.

ESG = Environmental, Social and Governance.

ESMO = European Society for Medical Oncology.

EZH2 = Enhancer of zeste homolog 2.

EZH2m = Enhancer of zeste homolog 2 mutated.

FPI = First patient in.

FDA = Food and Drug Administration.

FGFR = Fibroblast growth factor receptor.

FLT3 = FMS-like tyrosine kinase 3.

GAAP = Generally Accepted Accounting Principles.

GC = Gastric cancer.

HR = Hazard Ratio.

Hainan Pilot Zone = Hainan Boao Lecheng International Medical Tourism Pilot Zone.

HKEX = The Main Board of The Stock Exchange of Hong Kong Limited.

ICML = International Conference on Malignant Lymphoma.

IDH1/2 = Isocitrate dehydrogenase-1 OR isocitrate dehydrogenase-2.

IHCC = Intrahepatic cholangiocarcinoma.

IIT = Investigator-initiated trial.

IND = Investigational new drug application.

Inmagene = Inmagene Biopharmaceuticals.

In-market sales = Total sales to third parties provided by Eli Lilly (ELUNATE®), Takeda (FRUZAQLA®), AstraZeneca (ORPATHYS®) and HUTCHMED (ELUNATE®, SULANDA®, ORPATHYS® and TAZVERIK®).

Ipsen = Ipsen SA, parent of Epizyme, Inc.

IRC = Independent review committee.

ITP = Immune thrombocytopenia purpura.

ITT = Intend-to-treat.

JAK = Janus kinase.

JAMA = Journal of the American Medical Association.

LPI = Last patient in.

LPR = Loan Prime Rate.

MAPK = Mitogen-activated protein kinase.

mDoR = median Duration of response.

MET = Mesenchymal epithelial transition factor.

METex14 = MET exon 14 skipping alteration.

MLL = Mixed-lineage leukemia.

mOS = median Overall survival.

mPFS = median Progression-free survival.

MSS = Microsatellite stable.

NDA = New Drug Application.

NET = Neuroendocrine tumor.

NHL = Non-Hodgkin lymphoma.

NHS = National Health Service in the United Kingdom.

NHSA = China National Healthcare Security Administration.

NMPA = China National Medical Products Administration.

NPM1 = Nucleophosmin 1.

NRDL = China National Reimbursement Drug List.

NSCLC = Non-small cell lung cancer.

ORR = Objective response rate.

OS = Overall survival.

PBOC = People’s Bank of China.

PD-1 = Programmed cell death protein-1.

PDAC = Pancreatic ductal adenocarcinoma.

PFS = Progression free survival.

PI3K = Phosphatidylinositol 3-kinase.

PI3Kδ = Phosphoinositide 3-kinase-δ.

pMMR = Proficient mismatch repair.

pNET = Pancreatic neuroendocrine tumor.

PRCC = Papillary renal cell carcinoma.

PTCL = Peripheral T-cell lymphomas.

R/R = Relapsed and/or refractory.

RAS = Rat sarcoma.

RCC = Renal cell carcinoma.

RMB or “renminbi” = The legal currency of the PRC.

RP2D = The recommended phase 2 dose.

RP3D = The recommended phase 3 dose.

S&A = Selling and administrative expenses.

SHP2 = SH2 containing protein tyrosine phosphatase-2.

SHPL = Shanghai Hutchison Pharmaceuticals Limited.

SLL = Small lymphocytic lymphoma.

sNDA = Supplemental New Drug Application.

STAT = Signal transducer and activator of transcription.

Syk = Spleen tyrosine kinase.

Takeda = Takeda Pharmaceuticals International AG, a subsidiary of Takeda Pharmaceutical Company Limited.

TEAE = Treatment emergent adverse events.

TKI = Tyrosine kinase inhibitor.

TPO = Thrombopoietin.

TPO-RA = Thrombopoietin receptor agonists.

TRAE = Treatment-related adverse events.

VEGFR = Vascular endothelial growth factor receptor.

wAIHA = Warm autoimmune haemolytic anaemia.

WCLC = World Conference on Lung Cancer.